This year has been a long year of experimenting and pushing the boundaries of complex option trading. I have come to realize that a good strategy has a triangle of requirements that need to be fulfilled to be a valid scalable trade. Namely, it has to satisfy 1) margin and margin expansion requirements 2) Slippage, fills and real life initiations of the trade 3)Good backtest results.

Pre 2017, backtests were generally good enough because everything was standard and because of this, generally, if it backtested well it would do well enough live. We used standard width PCS and PDS and combos therein, and generally putting those on were quite easy and can be done without much directional risks. IE putting on PCS then instantly putting on the PDS or even filling them as a condor or butterfly. Not a big deal.

This year, I got excited about a few strategies based solely on backtests,–> really good backtests. Almost ‘end game’ nothing else needed type of results. This specific trade required a high vol entry and I patiently waited for this entry in what ended up being the lowest volatility period on record, it didn’t come. Time was wasted from Sept-Nov. Then we had some red days and I licked my chops ready to get trades on, unfortunately, it was met with disappointment. Now, I did put on a few sample tests before but it was in relative low vol and the trade was OK to initiate in low vol as the market didn’t move much and I’ll get into why that ends up being important. Something I didn’t realize. The non-standard widths in the credit spreads were very very difficult to fill. It wasn’t low hanging fruit the market makers could understand and hedge. It was too exotic. Coupled with the PCS you had to initiate long puts that had some combos @ ATM and some OTM (the hedge portion). However, in a fast moving market these things move quickly. So there in lied the rub. IF you got filled on the long puts, there was no guarantee you could get filled on the PCS. Leaving you incredibly exposed. If you got filled on the PCS, it meant that the market was moving against your longs (the makers apparently called them STUPIDS) and you will pay a really bad price for the longs as they become high in demand. Filling this trade in size was a nightmare.

So some people had ideas about using ratios. I gave it a shot the next red day. Again, I had mega issues getting fills on this. It just was untenable. But I did manage to get on about 150 units of this trade through a lot of pain.

The backtests were great, it was the trade of all trades..but filling this live was a different story. It’s all easy when you just enter the trade and press commit in a backtest, not so easy in real life.

The next issue was margin, at first I didn’t have much margin issue at IB but as time went on, all of these seem to margin expand to abut 13-14k a unit! This made the trade almost untenable from a margin perspective. Gross use of capital. So not only did I have a nightmare fill situation but I had a nightmare margin situation. IB doesn’t take into account the full benefits of the longs below a certain delta (in this case our spread was so large that the margin hit from the short was not getting covered at all by the longs). This isn’t such an issue at Think or Swim but at IB it is.

So a dream trade from backtests became somewhat a nightmare trade from a margin and live slippage/initiation perspective. Lessons learned and 3 months of opportunity potentially wasted.

These things you just can’t know. And again, this year was a year of exploring every nuance of complex option trading and it ended my year at best break-even. But the year was the most successful year in growth as a trader and I feel there is not that many more stones to turn. We’re (my PMTT group) are approaching the apex of what’s possible with respect to the triangle of requirements in complex trades. Guess what? It’s gone pretty much full circle for me. I am actively trading STTs and variants of BSh factories and the last 1 month of doing this has produced great result. Now on to formalizing this as a base trade and putting capital to work with what is proven to work and not into nuanced complexities.

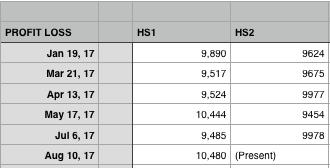

Here is the summary of how my year from memory:

1. Jan/Feb I still had on legacy Rhino structures that got smooshed from the incredible trump bull run. Remember these? They hate 4%+ up moves in a cycle. Love everything else. During this time I started testing the new STT/BSH stuff. I started off with BSH and waited as per the rules to finance with PCS on a down day. I think we had a 14 day bull run there with no opportunity to finance, this is extremely abnormal. Bad timing. So the BSHs put on lost money because they couldn’t be financed. Not a great start. The STTs obviously as they always do, did great.

2. March/April I start testing a combo trade I came up with called the PC2 and PC3. The PMTT group seems to like it as well. The tests were insane. Really good. But I miscalculated margin requirements and put the trade on the shelf. I documented this in the blog here even. Exciting stuff. Shelved due to miscalculating margin requirements (I entered each segment into IB and added the margin up). During this time, we used a method that tested very well but failed to deliver during this specific period as a way to finance the BSH. The BSH/STT combo broke even. During this time there was a cross expiration skew issue that kept the financing method from paying off the BSH costs. These are all legacy methods of financing that aren’t really used. Learning process. Backtests of the RC financing method did great. Just we had a bad period here…timing was poor.

3. May/June/July Extremely low volatility, RCs still not working, unable to really have opportunity to put on some good STT trades due to low vol. Start looking at PC2 again and do extreme testing and was aiming to present in September at the PMTT group. Basically broke even through this period. Poor pay off of the BSH. The PC2 had we started in April would have been hitting profit target every single month this year! The financing method is built into the PC2. Unfortunately, I calculated margin wrong and didn’t initiate, instead I used RCs which just did not pay off the cost of the BSH and we were slightly profitable but more or less break even during this period. Maybe up 7%?

4. Aug I entered some T5 (just about 40k worth). Along with most of the group. This was a juicer trade, a trade meant to pick up our returns. It is the most POSEV trade but its got variance. Variance I can accept though. We entered and experienced one of the worst skew issues you could imagine due to the NK missile issues. Vol sky rocketed in January options but not so much in earlier expirations. This caused massive draw down. Most of which was eventually recovered through October. But this was the highlight of August. Also during this time, I realized error of margin re PC2 and started heavy heavy testing and was ready to deploy a mastermind session in September.

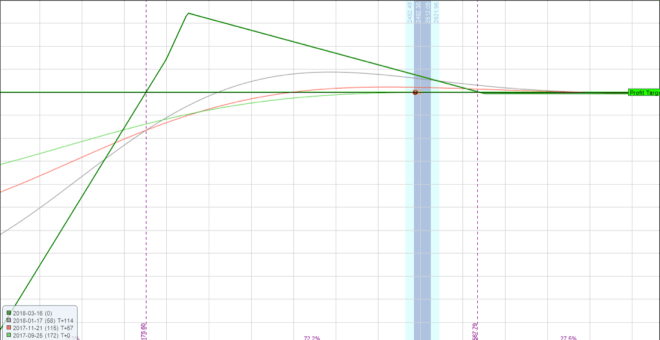

5. Sep The HS3 and Fulcrum ideas come out. They tested so well. Dream like almost. Read the beginning of my blog post for more info. It needed high vol entries. Vol was extremely low and historical. We wait patiently for opportunities.

6. Oct Market runs up, I took off some Dec PCS in what was record low vol, with intent to get off PDS next day or so on any slow down. Again, the market gapped up like 1-2% and I destroyed my Dec STT profitability and actually went negative.

7. Nov I decide to enter moderate size of Rhinos thinking we’re apex’ing and unlikely to experience sustained and large up moves. That was wrong, Rhinos were exited at fairly big loss.

8. Dec I finally put live all the good core trades, they do great and recover a lot of the losses from before. STT, PC2 and BSH factory is producing great returns. Onward into 2018 this will be the core.

The interesting thing about all this is that the complexity of all these strategies is solely based on how to hedge them from risk. it’s not about seeking out max EV or anything like that. I say max EV because seeking out max hedge is equivalent to maximizing profit at least from a risk perspective. Max EV trades are trades that have the highest expectancy and this can be without regard to variance. The highest EV trade I know of is called the T5 which is taught in the PMTT Mastermind group.

Anyway. That’s a sum of the year. You can see it was a lot of experimenting and backtesting and trial. In the summer, I was backtesting an average of 4 hrs a day on 20 or so new variants of strategies. Though I may still be backtesting going forward, the core bulk of cash will be put to work in combos of STT and self financed BSh. The STT always produces, it did though 2017, it was the BSH not getting financed that caused the meh results. THat’s solved. Excited to see how this thing does through the year.

More to come.