Haven’t posted for a while mostly because I find it hard to post things that are intellectual property sensitive and now its even harder since I’ve gone back completely to the original course trades with slight tweaks. A 360 with nuance. How do I present interesting things when I can’t post the trade 🙂 But I am going to keep trying and hopefully try to post every few days…maybe more on my mindset, thoughts, challenges of managing larger account sizes etc. Whatever comes to my mind.

So first and fore most, My last post from like late Nov was emotive and when I just re-read it I realized just how confusing and unrepresentative it was of almost everything. Horrible. I wrote it and then kinda forgot about it and obviously didn’t proof-read it. So I finally edited it. I’ll explain more and why I did so below. I’ll start with the market and get into the events and where I am now:

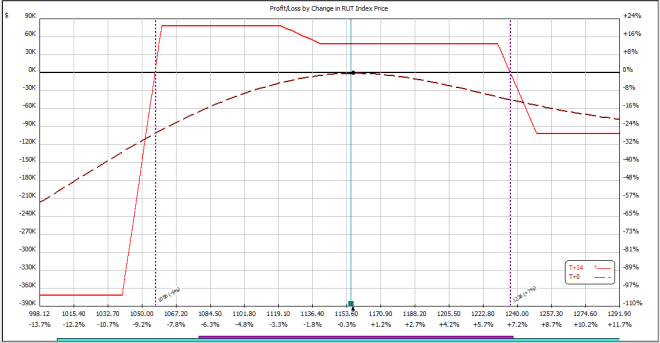

We’ve just gone through a 20.5% fall in the SPX and it started in late September and was a culmination of two specific time periods (October and December). Both periods fell quite hard often following square sine wave type patterns (short abrupt moves down) then a pause and then a small bounce and more short abrupt down moves. And what was very unusual about it was that it didn’t have the same volatility spike you’d normally see. Nor did the actual volatility get reflected in the vol index or options pricing. The volatility in the market was not being priced according to actual volatility. Perhaps it was the complete annihilation of specific vol products in Feb that helped create this old relationship for the last 4-5 years (and subsequently all of our backtesting data) or perhaps its a new market pressure present. Who knows. The point is, we had a big big down move in 3 months and we didn’t have a vol spike that some rely on in specific vol type hedging. This created problems for people that created vol hedges based on data that we’ve only had really (intra-day) since 2011. Some created a ratio type hedge we called a KPBR. In backtesting, the thing pretty much was free. Paying for itself. No drag on income trades. Sounded good. But a few of us pointed out that the sea of death can be a big problem in specific market environments. I was initially excited but when I tested it, thought about and realized what could potentially happen, I insta-closed out the units I had on and fully relied on traditional BSH types.

Here’s what I said in the group as a polarized and probably rude comment re the KPBR

“I don’t want to be sitting up one night during the 4th day of a big down move/event and wondering if the market crashes tomorrow will the KPBR trigger or will it draw down further and I doubt I’d be thinking “Hey, my account is down 30% but at least my hedge was free” :)”

The thing with that hedge and even with the HS3, is that a slow large grind down will result in a very large draw down in the trade itself. These trades are just too exotic for me. So I am back to the basics (original PMTT BSH and BSH factories etc) I get that over time you probably will have the same cost (like over 5 years the KPBR may actually break even) but that doesn’t matter and here’s why: We are humans we have to cater to our human factors, our psychology if you will. How each trade and the management of our portfolio will feel and how it will affect everything from our ambition, motivation, sleep and our responses to trading our plan etc. If we are utilizing such a structure like the KPBR as a hedge to our OTM trades and we have an environment that temporarily draws down our STT by say a super standard 600-700 a unit (totally can happen in a heavy skew change due to a larger down move where way otm doesn’t quite spike) and our KPBR also draws down 600-700+ (I actually saw it go double that!) then you’re sitting at a draw down that could affect your trading mentality. You’re now sitting there at night, wondering if there is another big down move in the AM, will your KPBR trigger to provide some protection? what if it doesn’t? what if it draws down even further and more vix hurts my STT? All those doubts will cause you to probably make mistakes, burn out, lose sleep, or lose some humanity itself. I don’t want to be sitting up at night wondering if in the morning if my account will be down 30% but hey I got those KPBRs for free!

Most of you reading the blog know the STT inside and out, we know how much it’ll draw down in vol events, we know how to adjust it, we know it’s really docile and works well as a trade. Especially opportunistically. Having a 600-700 vol draw down won’t even make my heart rate increase 1 beat nor would I lose an ounce of sleep. Because I know it and I know how it will progress forward. The problem with the STT is a black swan, you need protection. That’s it really, just a black swan. Hence, why we need black swan protection. An STT alone w/out BSH protection can handle the 20% decline we saw in Oct-Dec because it wasn’t a shock event/swan. But imagine that you have the STT on and you have that 600-700 drawdown that you usually are not concerned with but you also have this 1k draw down in your hedge. Then things get really funky upstairs (in your mind). It starts to affect you in a variety of ways. Hence the need for protection that you understand.

So yeah, here we are now, Jan 29th, the market has fallen 20%+ and rebounded about 13% in a super V recovery. I’ve moved to trading a BSH factory (two versions: Income and hedge/lotto), an OTM Jeep type trade using the STT engine as per the course (not an ATM jeep ala the weirdor!), some rhinos and a base of standard equity type stuff (logical-invest), some earnings plays and that’s about it. Nice and simple.

I concluded that I will heavy trade STT opportunistically by itself (no BSH) when VIX is above 22 and especially if we have an MDD type day but I won’t trade them much in very low vix environments and instead I’ll do a version of the course JEEP trade probably with some directional bias (signals).

I was profitable through the Oct/Dec events and the STT put on in Oct event was insanely easy to manage through Dec. I loved that.