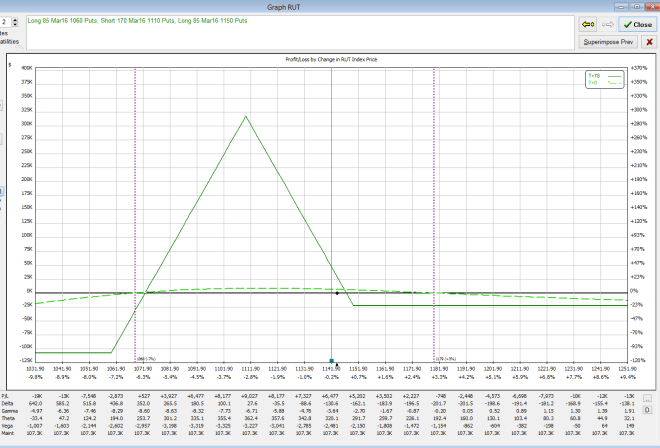

I started the day pretty delta negative and took off a few 1140 BFs around 10 min into market open (i regretted this later) based on prices I had calculated as good from the days previous. Usually you can get exceptional fills in the first 15-30 min of market open but only if you really know what the price should be as spreads tend to be larger. I don’t usually do this as I wait for normal adjustment times, but this time around, I had put in orders at prices much higher than on Friday. They got filled. Though I corrected some negative delta’s, the RUT started to fall quite a bit (about 1.5%) and that increased volatility had me in a bit of a scurry removing portions of the trades and keeping things relatively balanced. Ended up at EOD better off than we were @ open or at close on Friday. Unwinding the large M3s that I had on is much more complicated than the Rhinos.

I got about half off today and will be removing the rest through the next few days. The trades are all more profitable then they were on Friday, so all is good. I ended the day fairly delta negative again. I’ll need to get more BFs off tomorrow to get it balanced out but likely it’ll just be a day of peeling off the December trades once and for all. All of the trades were very profitable.

I read some neat things today:

1.

“…since 1994, more than 80 percent of the equity premium on U.S. stocks has been earned over the twenty-four hours preceding scheduled …FOMC… announcements”

“…without the indirect boost of FOMC meetings, the S&P today [would] be at the same level it was 20 years ago!”

and

2.

There is 1.1 Trillion of options expiring 2 days after the FOMC meeting. It’s the largest LEAP month ever. Typically price can sometimes pin to where the most open interest is. In this case its 1800 which is 200 points downwards. Neat.

http://www.zerohedge.com/news/2015-12-07/beware-massive-stop-loss-jpms-head-quant-warns-unexpected-downside-catalyst-looms-ne