The last few days it appears we have found a ‘game changer’ that accomplishes what the STT+BSH trade does but without all of the issues that come with financing BSHs and relying on timing requirements for said financing and BSH initiation :). Basically, the entire thing I failed at doing properly this year due to how crazy the market’s been with both OTM puts holding value in the STT. The BSH financing wasn’t working across expirations via the reverse calendars and I was not getting any significant down days to get on naked puts to finance the opportunistic BSHs I put on. I heard this year was the historically worst year for 0.3% or more down days. There was barely any. Like the environment was with Rhinos, the worst possible, this environment was with this STT+BSH trade. Apparently I have the worst timing. I’ve been checking across option disciplines, it seems any delta neutral strategy has been failing since May due to the OTM puts holding value due to binary event type environment (War w/ NK can start, missiles can be launched on weekends, debt ceiling, Trump idiocy, and so on). This includes M3, Rhino, STTs themselves, combos, time trades etc.

There’s a few groups of trades we work on, one set is based upon cross expiration skew reversions and we call these time trades (TTT, T5 etc) which are usually not model-able in the sense that we can rely on any option software modelling to produce a risk profile of any real value. From backtesting, we know that they have probably the most EV of any trade we’ve done but they also lose on unpredictable internal market events (not market movement) but rather skew changes across expirations. This can cause draw downs of 100-300% though rarely. On the opposite end, they produce 100% returns regularly on an average of 10-12 days in the trade. The group was putting so much time into these trades (no pun intended) but we could only ever use 1-3% of our accounts. These types of trades take a lot of time to get comfortable with and it requires a lot of backtesting various conditions.

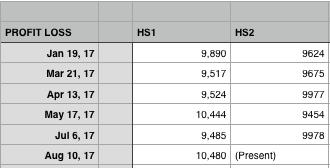

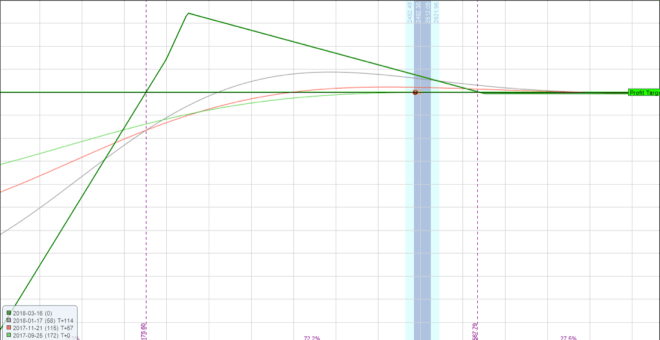

Thankfully, the focus of the group shifted to risk profile versions of our base trade…namely the STT and BSH and combos therein. The start of the movement away from relying on BSH financing and timing came with the advent of the PC2 which does really well but requires 45-60 Days in trade,is very cumbersome and requires 2 BSHs, a financing put and a PCS and PDS (STT). That’s a LOT of contracts/commissions, a lot of opportunity for slippage all while the p/L target for the combo itself is quite low. IF there was no alternative, this would be the trade. For me!, I haven’t even started THIS trade live with size yet, I am still trading BSH+STT and financing methods therein. These trade profiles are fairly similar to each other across their iterations. the STT, STT+BSH or the combos that we’ve set forth, usually these are kinda known in how they’ll react and where they’ll have weakness. Then Ben G came up with a similar risk profile of these combos but with far less contracts, no requirement for BSH (it’s built in) and a much better greek profile. Essentially, a slap on trade with like 3 contracts (replacing 7) that is easier to initiate and has a better behavior. He called this the Sail trade (though it has similar profile to a combo, it looks more like a sail). He’s honed this over the last 4 months and realized its weakness is that it needed to rely on specific entries (be it high vol or be it using a trend system where delta is erred). If put on in High vol, it basically doesn’t lose and produces 10% on margin. The trend following one is similar. Ron then produced a trade that again, mimics the profiles of a combo trade but with a MUCH MUCH simpler setup, better greeks, better everything at least compared to the PC2. It’s temporarily called the Fulcrum trade. Basically the last 3-4 days we’ve had people from all over the world back-testing it and Ron’s mentioned it will be the replacer of his entire base trade, namely the STT combos 🙂 I would agree. It’s solid. Though it appears we have a game-changer, it requires very onerous testing to ensure and hone how adjustments are made and where to setup profit taking etc. Now I need to test every single possible date even though I know a trade with this type of profile is docile and has already really been tested in various forms before. I’ve done about 25 different trades and so far the only time its break-even to slight loser is during the last 2 months re binary events and out of the money (OTM) options just not losing much value.

The trade does 5% on margin if its outside tent and 10-20% if it’s inside tent. It will do better if we err starting deltas using a trend system and the average DIT is around 30 from what I’ve seen in my backtesting.

This new trade replaces the STT+BSH combo with a much simpler more powerful setup, it’s a lot less contracts, it can be put on in ANY market condition, it’s an “always-on” type trade. The greek profile is fantastic, it does well through Aug 24 (max profit!), it crushes the Jan 2016 market and it does well in low vol. What more can you ask for! We can do it in futures and we can do it in SPX and possibly RUT. We’ve got scaleability and we’ve got low variance. Can’t wait to test this thing more. I do have 9 units on right now LIVE via ES on Friday. Wanted to test out execution.

I have a feeling the STT+BSH (using financing methods) and the PC2 might have just become an antiquity right now.