I’ve been backtesting 3 variants side by side from 2014-2017 w/ entry during a SPX down day of at least 0.5% and a corresponding VIX spike. The High vol entry makes the management of the trade much easier, the more the spike and down, the easier it is to manage. I’ve been testing the HS1, HS2 and the new fulcrum trade . I am not done yet but it’s close. I will be presenting at a mastermind next week and will be talking about the trades and its results.

So far I’ve not had a loser for the HS1 variant which I manage in a specific way. The drawdown has been less than 400 a unit as well. Very very good. The average days in trade is about 48 so far and the return is about 12.5%. The more higher VOL entries will sometimes get to profit in 8-14 DIT especially in more bearish conditions. Beautiful trade.

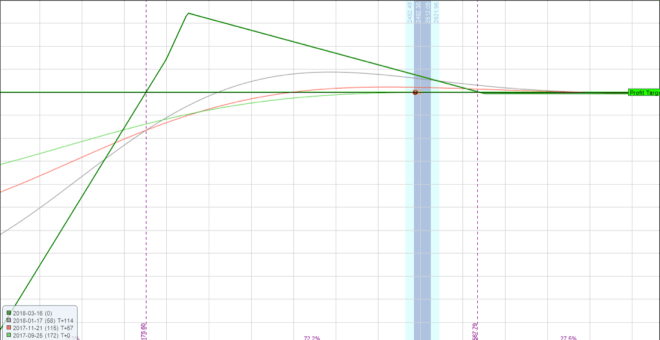

Here’s what it looks like at initiation:

Despite what it looks like to the left, in a black swan event, it will pick up and handle it just fine if not at a profit.

Here’s a few of the trade initiated around Aug 24 crash date:

Aug 20, 2015 ENTRY

Aug 21

Aug 24 Crash day

Despite the left side, it does pick up and reach profit target on the 21st AND almost double the profit target on the 24th.

The market moved from 2035 to 1890 and it did just fine.

The same goes for the Jan 2016 slow bear move down. It just crushes.

It looks like the trade is up 1% and 2% on Aug 21 and Aug 24, respectively. Is that the profit target? The green line is at 10%.

The margin on the left is useless. The actual per unit margin is around 60k for 10 units. It’d be up >15%

All those lines would be useless in this software as it doesn’t understand portfolio margin :S

I like it! What strikes are you using ?

Jerry,

In the August graph, it looks like a small long at 2150 and another at about 2110 or so, a large short at 1750, then maybe a small long at about 1725. This is net short/long and also could include diagonal/calendar time spreading.

It looks as if he adjusted from picture to picture though

It’s net long puts (3) w/ some premium selling and its all in single expiration. There are adjustments.

I thought so. When and where can we see your presentation on this. This is a huge theta tent !

What‘s the meaning of HS1 / HS2 trade and where can I find more about it?

Hi David,

It’s a trade (also add HS3 in the mix) that was developed over at Trading Dominion (mastermind) group.

https://academy.tradingdominion.com/pmtt/ref/2/

https://academy.tradingdominion.com/pmtt/ref/2/ Can click that link. It’s a link to the course and mastermind group that has all that info. Good community.

What has been happening with this trade? I don’t see any posts since Sept. 25.

great stuff here. what is the set up of your hedge?