This month has been the third most volatile month for the markets in history only being beat out by the 2008 financial crisis and the 1929 great depression. The overnight moves were extreme and made for the toughest markets for market neutral trading. Overnight gaps in each direction in the 1-4% range were regular and intense and quick reversals came at the drop of a dime. Going from an extreme low volatility environment to an incredibly high one is always going to be very challenging period for market neutral traders. Once in a high volatility period, it’ll be much easier to manage and probably a lot more profitable but the transition can permanently take out a lot of traders 🙂

I struggled immensely the past few weeks but finally had a decent week with some recovery. The MICs do not trade well in this environment and can be devastating in unexpected overnight crashes. The RUT moved from all time highs to about 17% down in the period of a few weeks. Crashes like what happened on Aug 24 will wipe out most iron condor traders. Luckily, those events are quite rare. If it happened during trading hours, it’d be a lot easier to manage. A study was done and it was found that 50% of the markets movement occurs in the futures between 3-4am during the past 7 years I believe. The market is more efficient and swift than in the past and I believe that it’ll make MIC trading a lot more difficult to manage than back-testing would suggest. In contrast, all the M3 traders I know are mostly positive (one is up 7%) and, remember, it’s still a market neutral trade that really doesn’t like movement. Yet it survived one of the most volatile months on record. That’s incredible. I’ve had a bunch of M3s on but not enough to even make a dent in the MIC losses. It’s a very resilient trade as you can see with the below risk profile.

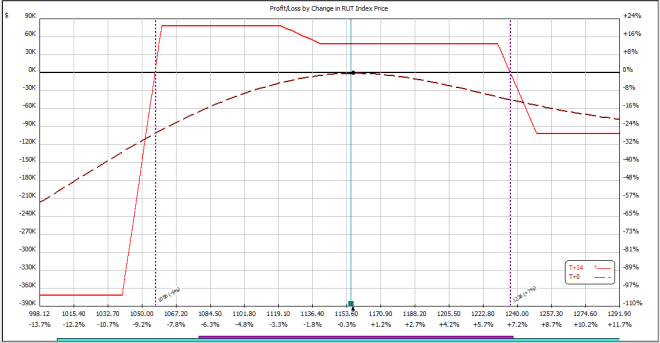

M3’s can handle market movements a lot better. Here is an example of an M3 risk profile:

The beauty of an M3 is how it compliments human factors. When I say human factors, I mean psychology and the things that challenge us within when trading. Things like taking losses with adjustments, or the opposite, adjusting to quickly out of fear etc etc. If you notice, you have no real upside risk and on the downside, you’re falling into profit being under the tent. So when you make an adjustment on the downside, you’re up money AND you’re usually taking money off the table. That’s a very nice adjustment in terms of human factors. As well, look at the room you have before you start losing money (almost what 5%?). Again, the beauty of managing this trade is its conservative risk profile, the fact that adjustments are mostly welcomed, and that a trader who’s keeping their T+0 line balanced will usually never have a problem with deviating from the plans so greatly that it affects the trade overtime.

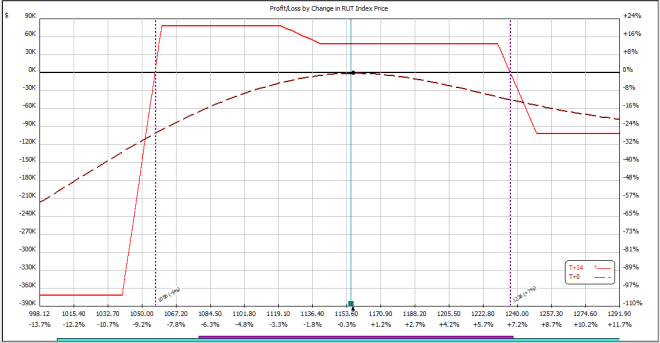

Here is an MIC risk profile.

You can see that on a quick fall (overnight) without the ability to protect yourself, you can have extremely large draw downs. This is especially pronounced as you get closer into expiry. Plus, this risk profile is taken in a high volatility environment, having put this on during Aug before the correction, it’d be even worse. That said, if you had the ability to adjust (moves happen DURING the day instead of overnight), then this trade is easy to manage. Overall, I mean, I loved the MIC trade until this month. I had a really rough month in the melt up in October of last year and I had a real rough month this month with the extreme overnight movements. For me, I just don’t know if its a trade that I can justify having seen how the M3, Rock and Bearish butterflies react. I mean, the MIC is a great trade for the most part, as you have quite a high theta and being in the green each month had a 93% success rate. It’s the extreme moves that occur overnight that really hurt and excessive whip saw. Both of those causes are what hurt me in the MIC trades recently. In hindsight, I should have closed the MIC straight away instead of trying to manage it through the week after crash. Hindsight is 20/20.