I didn’t take many trades off yesterday, though I think I might end up regretting that. I am waiting for Thursday and Friday to unwind the March Rhino and BB trades and to also enter the May trades.

I’ve got a ton of accelerating theta in the March trades and my thought was to wait for the typical theta unwind that occurs from Wednesday to Friday and start closing down everything starting late Wed, Thurs and Fri Morning. We have GDP on Friday, the G20 on the weekend and some other big news from Shanghai re central bank policy. I’d like to be out of all March before the weekend.

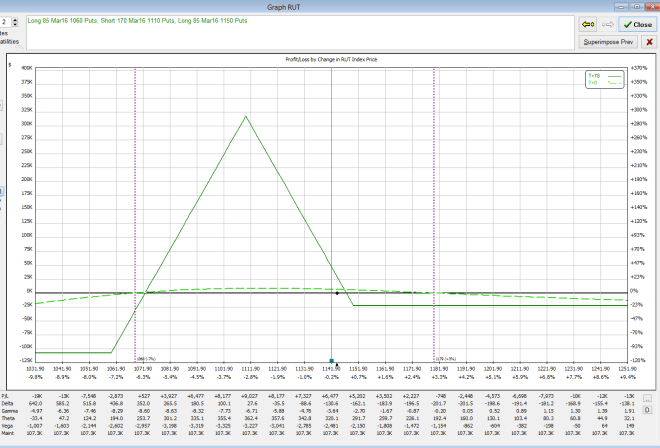

I feel like I over-adjusted to the upside yesterday. I don’t know. The March trades were holding a lot of negative deltas and my Aprils were as well. I figured I’d get the March ones down a bit while Aprils would be somewhat maintained. Today, on just a drop of 10, (gamma in the trades is picking up), I am already at about 0 delta. I gather I could have done without a few call calendars on the march trades because on such a small drop, I’d still want to maintain negative deltas. Gamma sure does pick up toward the end of the trade. Though, if it had continued up hard, I’d be probably saying the opposite. I’d hate to have a big big down move tomorrow or Thursday but that’s risk management eh.