Below are three sets of Rhino trades for April for three different accounts of mine. There are multiple tranches in each and the risk profile is a combination of several. I am not going to do any upside adjustments to any unless RUT breaches 1035 with authority.

1.

2.

3.

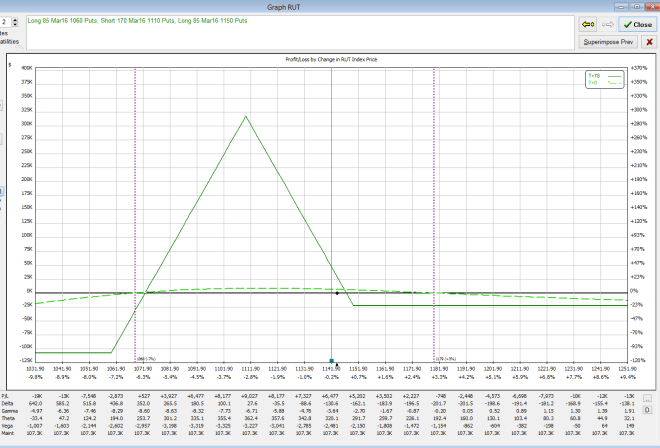

I started also putting on a new type of hedge trade called a “Space trip Trade” developed by Ron Bertino. This is essentially what ends up being a free hedge for large down moves but can also be an income trade in portfolio margin accounts where it takes very little margin. If the market stays neutral or falls, it’ll profit. The upside has little risk (-$600) and a 17% fall would produce 24k in about 4 months. The idea is to put on multiple tranches of this with both time and price diversity. It takes time for the profit hump to build and entering these periodically and @ different times and market positions, we should be able to get a nice hedge for our ATM trades like the Rhino and also produce some income on them as well. As time builds, we can remove our upside risk by rolling up the shorts a bit.

Here is what I have on below: