Through the thanksgiving week not much was happening on my end. During that week, I avoided adjusting in what was a low volume up grinding market and didn’t have much to post. Though I should have, I have tons of thoughts and ideas that I could record here. Laziness. I also need to work on the structure of the posts and the content therein. I had started posting my graphs and adjustments previously but then OV had the catastrophic modelling changes and I had to switch to an old VM and re-enter the trades anew. This meant the graphs were not from entry and were inaccurate re P/L etc.

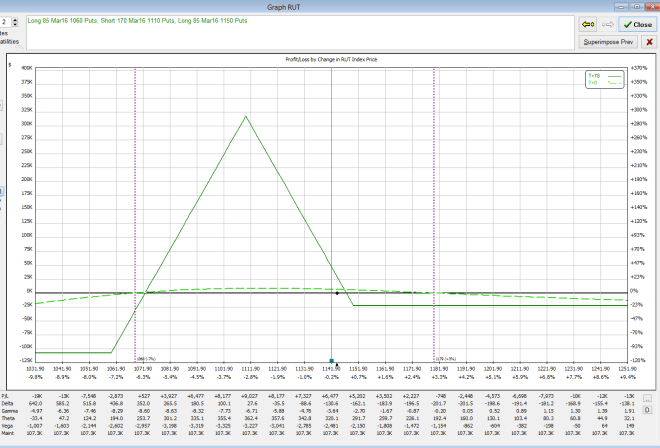

So yah, my intent was to get out 21 DTE but it was during thanksgiving week and the fills were poor. This was a bit stressful as the market grinded higher and higher putting pressure on my M3 trades. So I delayed exiting the trades and awaited some relief from the constant up move we saw (which is typical of a low volume holiday week). I was going to get out this week, but on Monday, due to the structure and safety of my trades, I decided to aim for Thursday instead (to pick up theta). Well, Thursday was a blood bath and volatility sky rocketed and though I sort of ended up exactly where you’d want to be in the graph, my P/L was nowhere close to what the models would suggest as Vega was a big issue with the massive increase in volatility. If the market stays exactly where it was but you get a decrease in volatility, then your position will gain its value. This happened on Friday, and in a drastic way (several %!). That’s one tricky thing about trading these things, the promised land isn’t always as it was promised re the models.

Today rolled around and the SPY regained all of its losses. By EOD, the trades have been relatively neutered and are doing fabulously. We should be out fully by Tuesday.

So on Thursday I ended up adjusting on the down move, buying some OTM puts, removing call calendars and call BWBs as we went from 1190s to 1160s right quick. My plan was to wait for a quieter day with reduced volatility to close the trades thus probably holding the trade into Monday/Tuesday of the following week. As I mentioned above, I couldn’t have been better positioned in the model but my P/L was literally $0 for the day despite the model suggesting massive profits. The theta was huge positive and vega huge negative, so as time passed and as volatility dropped, we’d see big recoveries on the trade. I had some reasons to believe the sell-off wouldn’t continue (see market recap section below). Then Friday rolled around and we had the biggest up day (sooner than I expected but) in all NFP Fridays in History I do believe. I mean, we went from 210 to 205 in SPY on Thursday only to from 205 to 210 on Friday. Intense (and challenging!). Volatility collapsed (fear left the market) and the trades sky-rocketed in value exactly as the model would have suggested. I adjusted and closed portions of the trades on the upside and we’re doing great re P/L. On Monday/Tuesday, I’ll finally get out of these M3 trades that remain for December (And quite profitably).

I’ve only got Rhino’s on for January and February. They are my bread and butter trade now. Love ’em.

Market Recap

A few weeks ago we’ve been slammed with very negative headlines that should have sparked sell-offs if we had weak hands in the market. We had the Paris attacks, WW3 nearly started with the downing of a Russian Jet by a NATO alley, we have 80% odds of interest rate rise in Dec which could cause liquidity losses equivalent to QE2 (600 Billion?) and still the market just brushed them off. The dip buyers in Aug/Sep are thick skinned (obviously) and if they didn’t sell in these headlines, its hard to image where they would. When the market shrugs off bad news and rallies, well, it’s hard to figure what type of event will cause a sell-off especially going into the Santa rally period. For that reason, I had suspected maybe a dip to the 1170 area but no more.

On Thursday, some big news came to of ECB, which caused currencies to go psychotic and brought about a big equities sell-off bringing the rut from the 1200 area to the 1166 area quickly. The exogenous nature of the news and the unknown effects of such big currency moves, did have me quite worried about my previous plan of expecting a dip to max 1170. I probably over-adjusted because of that. The TRIN wasn’t confirming the down move either. The thing is, in the market, when you’re a seller, you only get one vote and that’s it. You sell. That Thursday, we ran out of sellers, the one small group of over zealous traders that had weak hands are now gone and have no vote on Friday, what other weak hands were there after that day? Who had not sold on Thursday but would have sold Friday? We ran out of sellers and short interest was high, that is why we rallied off modest NFP news. I should have weighed that more. It’s all it took. Now we’re back to ~210 on the SPY. We have strong thick skinned hands in this market and we’re probably poised well for the Santa rally that everyone so expects.

The one thing that counters this is the terribly (sickly) breadth only 37% of NYSE stocks are above 200 day moving average while market is at all time highs (that’s not good),the bullish percentages are weak, smart money is not buying huge and we’ve got more distribution than accumulation suggesting a topping phase.

As for February trades,

I entered more at close today (1190/1150/1100) BWBs. I’ve got some (1200/1160/1110s) already active. That’s it.