This month has been the third most volatile month for the markets in history only being beat out by the 2008 financial crisis and the 1929 great depression. The overnight moves were extreme and made for the toughest markets for market neutral trading. Overnight gaps in each direction in the 1-4% range were regular and intense and quick reversals came at the drop of a dime. Going from an extreme low volatility environment to an incredibly high one is always going to be very challenging period for market neutral traders. Once in a high volatility period, it’ll be much easier to manage and probably a lot more profitable but the transition can permanently take out a lot of traders 🙂

I struggled immensely the past few weeks but finally had a decent week with some recovery. The MICs do not trade well in this environment and can be devastating in unexpected overnight crashes. The RUT moved from all time highs to about 17% down in the period of a few weeks. Crashes like what happened on Aug 24 will wipe out most iron condor traders. Luckily, those events are quite rare. If it happened during trading hours, it’d be a lot easier to manage. A study was done and it was found that 50% of the markets movement occurs in the futures between 3-4am during the past 7 years I believe. The market is more efficient and swift than in the past and I believe that it’ll make MIC trading a lot more difficult to manage than back-testing would suggest. In contrast, all the M3 traders I know are mostly positive (one is up 7%) and, remember, it’s still a market neutral trade that really doesn’t like movement. Yet it survived one of the most volatile months on record. That’s incredible. I’ve had a bunch of M3s on but not enough to even make a dent in the MIC losses. It’s a very resilient trade as you can see with the below risk profile.

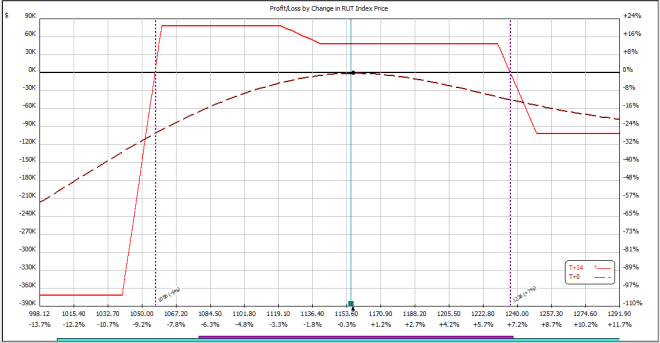

M3’s can handle market movements a lot better. Here is an example of an M3 risk profile:

The beauty of an M3 is how it compliments human factors. When I say human factors, I mean psychology and the things that challenge us within when trading. Things like taking losses with adjustments, or the opposite, adjusting to quickly out of fear etc etc. If you notice, you have no real upside risk and on the downside, you’re falling into profit being under the tent. So when you make an adjustment on the downside, you’re up money AND you’re usually taking money off the table. That’s a very nice adjustment in terms of human factors. As well, look at the room you have before you start losing money (almost what 5%?). Again, the beauty of managing this trade is its conservative risk profile, the fact that adjustments are mostly welcomed, and that a trader who’s keeping their T+0 line balanced will usually never have a problem with deviating from the plans so greatly that it affects the trade overtime.

Here is an MIC risk profile.

You can see that on a quick fall (overnight) without the ability to protect yourself, you can have extremely large draw downs. This is especially pronounced as you get closer into expiry. Plus, this risk profile is taken in a high volatility environment, having put this on during Aug before the correction, it’d be even worse. That said, if you had the ability to adjust (moves happen DURING the day instead of overnight), then this trade is easy to manage. Overall, I mean, I loved the MIC trade until this month. I had a really rough month in the melt up in October of last year and I had a real rough month this month with the extreme overnight movements. For me, I just don’t know if its a trade that I can justify having seen how the M3, Rock and Bearish butterflies react. I mean, the MIC is a great trade for the most part, as you have quite a high theta and being in the green each month had a 93% success rate. It’s the extreme moves that occur overnight that really hurt and excessive whip saw. Both of those causes are what hurt me in the MIC trades recently. In hindsight, I should have closed the MIC straight away instead of trying to manage it through the week after crash. Hindsight is 20/20.

Hello, really enjoy your blog. In terms of the M3, where did you learn this trade, did you purchase John Locke’s courses, if so which ones. Do you have any issues getting filled on the put butterfly, what is your methodology to ensure you are getting a decent fill in the initiation of the trade.

Thanks,

Al

Hi Al,

I purchased John Lockes courses and am part of a private group that trades these things. Every week we get together and discuss and actually a few members post presentations during this time period. Super cool.

There’s a few things you can do to ascertain if you’re getting fair value. Though it is difficult to figure out what exactly is fair value since its like trying to find value of a used car based on price and bids and not the actual value of the car.

To see what the mid price should be at, I use a program a fellow on the Capital Discussion board designed. You can get it as well (its at bbpricer.com). It synthetically calculates the prices of a butterfly by synthetically using 3 variants i.e. the iron butterfly, put butterfly and a call butterfly and from that you can see around what the mid price should be. I then come in lower and work my way up. Helps a lot!

The other thing you can do is use option Vue back-trader to ascertain fair prices for BFs during past time periods. I highly suggest John Lockes APM program which has a whole section on this.

I sometimes get filled below the mid and other times I don’t at all. It’s frustrating but it is what it is. John Locke suggests erring to the side of selling on high value days and buying on low value days. Lately, I’ve been getting a feel for where the BFs will fill.

Hope that helps.

Hello,

I’m the author of BBpricer. Thanks for mentioning it and the kind words.

I discovered your blog a few days ago and I’m reading it now in reverse order. I’m fascinated by your journey starting M3 and other Locke trades.

Too bad your road trip to Hamburg, Germany, happened already. I’m living there.

I wish you all the best.

Uwe

Hi Uwe,

Thanks for making the tool. It’s very useful.

I loved Hamburg, we stayed there for a week and I am looking forward to going back. If we do, I’ll shoot you a message 🙂

Patrick

I have written a better version of BBpricer. It also allows broken-wing variants. If you liked BBpricer, you will like it even more 😀

https://www.option-poption.com/

Awesome. I’ll get it installed on my VM and play with it. Appreciate the heads up.

Thanks for the response, I am a member of capital discussions and find it so valuable. I am at a point that I am trying to determine whether to go with Sheridan Mentoring or Locke. Capital discussion members really love the M3 and most seem to be very experienced traders such as yourself. On the flip side most of these traders originated in Shetridan. Either one, I think will be fine, I might be leaning towards Sheridan.

Any feedback would be appreciated.

Thanks again and safe travels!

Half of the people in these groups are ex-sheridan mentor students like you said. I think it speaks volumes to what it produced but the sense I get now is that it’s maybe a bit passed its time and I think there is better out there.

By the way, I was quite impressed with the Rhino trade that Brian Larson produced. He’s going live with it tomorrow. It’s a neat take on an M3 like T+0 line. I like it.

I like the rhino trade as well and I am following it, one thing I am playing with is using an iron butterfly as opposed to an all put butterfly. I am just more comfortable with adjusting IB and bieng able to put them on as two separate verticals. Either way I will follow Brian’s rhino the way he designed it.

Thanks again for all of your advice.

I had the same conundrum but did a lot of research and opted for Locke. I like his trading style and his community. The group I am part of now is insanely bright and I like the weekly meet ups and presentations. I talked to a lot of other people about the Sheridan mentor program (who’ve done it) and got the sense that they would recommend elsewhere. I was about to join and those comments along with some other reasons, I opted out. So yeah. I’d highly recommend doing the courses with John Locke and I’d also highly recommend the steady options site too if you haven’t been there. I’ve been with them from the start and its a fantastic community.

I found your blog yesterday and it is absolutely amazing . Almost like reading 21st century version of “Reminiscences of a stock operator”. Please keep writing.

In your previous reply you talked about Group 2 meetings of Capital Discussions, correct?

Now you like Rhino trade more than M3 and BB . Is it mainly due to slippage issues because of very large number of multiple legs to be adjusted or for some other reasons.

Hi SVL,

Sorry I never replied. I just realized I hadn’t right now.

I appreciate the comments. I have to post better content and more often 🙂 A goal for this year.

For some reason, I really feel the Rhino trade in that I am extremely comfortable with its risk profile, the adjustments and how it reacts in various environments. I feel that it’s a tad more predictable and easier to manage than the M3. I also do like the BB but with much less position size re the volatility of that strategy.